An introduction

Bitcoin is the worlds first ever digital currency, it came into existence in 2009

and has a market capitalization of over $600 billion. Transactions involving

bitcoin are recorded on a public ledger, which shows transaction for each

unit and is used to prove ownership. Unlike traditional currencies bitcoin isn’t

issued by any central authority neither does it have any government backing.

And investing in bitcoin is quite different from investing in stocks or bonds as

bitcoin is not a corporation, hence there is no corporate balance sheet. But

one question many seek answer to is what actually determines the price of bitcoin. How before we discuss how bitcoin gets it’s value lets take a look at

the price history of bitcoin since it came into existence.

Price history of bitcoin

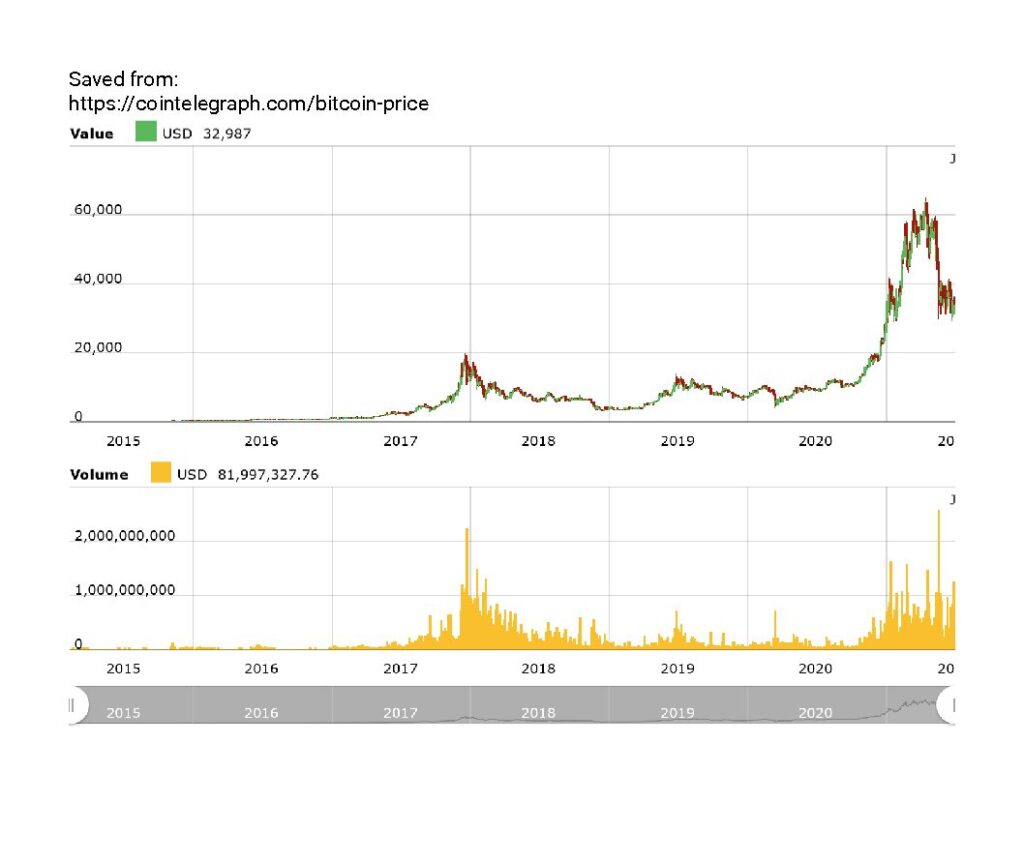

As at 2009 when bitcoin came into existence it had no value, bitcoin’s

witnessed it’s first move in 2010 when the value of a single bitcoin jumped to

0.8 dollars from around 0.0008 dollars and ever since has undergone several

rallies and crashes reflecting investors enthusiasm and dissatisfaction with bitcoins promise. Below is a graphical representation of bitcoin’s price history adapted from Cointelegraph

What determines the price of bitcoin?

The price of bitcoin has undergone multiple bubbles since it first introduction

over a decade ago, known for it volatility there are noticeable factors that

determines the price of bitcoin ranging from the demand of bitcoin as an

asset to hedge against inflation to government regulations which it’s impact

could either be positive or negative on cryptocurrencies as the case of China’s ban on cryptocurrency.

Another factor that has contributed to the price of bitcoin is the involvement

of institutional investors. The interest of institutional investors has cast an ever-lengthening shadow on bitcoin, as in recent years bitcoin has become an attractive asset class to institutional investors, giving it global recognition and a wide acceptance that the narrative of bitcoin has shifted from being a currency to a store of value as a hedge against inflation resulting increased government spending during the pandemic. Other factors that can also influence the price of bitcoin are it’s availability, and competing cryptocurrencies.

Bitcoin Vs Other Cryptocurrencies

While bitcoin is the first ever cryptocurrency created and likely the most popular cryptocurrency, there are hundreds of other cryptocurrencies that has gained attention including Ripple (XRP), Ethereum (ETH), Tether (USDT), Dodge Coin (DOGE), Binance Coin (BNB) amongst others competing for user attention.

However, it is a common phenomena for the price of bitcoin and other cryptocurrency to move in a similar direction as seen over the years, though bitcoin has always got the edge over other cryptocurrency due to it’s visibility. For good rates on bitcoin and other cryptocurrencies visit Nairadirect and Exchangeindeed platform.

What the price of one bitcoin would worth in the future can not be ascertained as there several factors that determines the price of bitcoin which are primarily its supply, the market’s demand, availability, competing cryptocurrencies and government regulations.

Discussion about this post