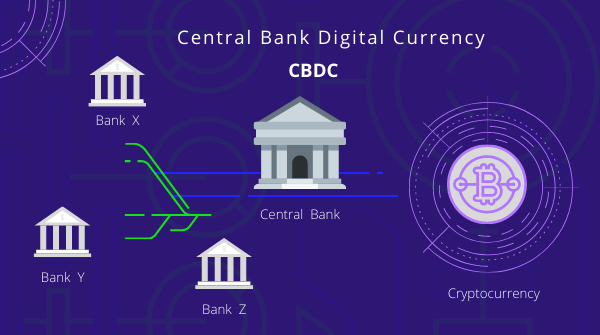

Central bank digital currencies are a digital version of a country’s fiat currency. But unlike cryptocurrencies which are decentralized and provide anonymity for it’s holders , central bank digital currencies are centralized allowing central banks to identify the holder’s of each wallet. If we consider how a central bank digital currency (CBDC) could transform all aspects of the monetary system, we could find that the central bank digital currencies can serve as a practically costless medium of exchange, secure store of value and a stable unit of exchange and this could impact cryptocurrencies.

Obviously the potential losers from the implementation of central bank digital currency will be banks and non-bank financial institutions (Fintech Companies) who rely on customer’s deposits because the customer’s could ditch fiat currencies for central bank digital currencies. But the objective question is how will it impact cryptocurrencies?

What impact would central bank digital currencies have on cryptocurrencies?

The central bank digital currencies were inspired by the development and increased

adoption of cryptocurrencies. CBDC is becoming more popular as nations embrace

the idea of having its own digital currency, with the Covid-19 crisis speeding up

Asia’s future of CBDC. However, despite the similarities between CBDC and crypto currencies they are two distinct phenomena.

While central bank digital currency is issued by a nation’s central bank and distributed by financial institutions across the country, cryptocurrencies are mined on

the blockchain. There is a growing concern that CBDC would be implemented all over the world in the nearest future as it is believed that central bank digital

currencies would strengthen the fiat currency and still remain relevant. But the

implementation of CBDC could also lower the entry barrier to cryptocurrencies for an

average person seeking to penetrate the crypto world because such individuals are

already familiar with digital money issued by central banks.

However, on the long run the impact of central bank digital currencies might also

prove unfavorable for cryptocurrencies as crypto speculators could abandon crypto currencies for central bank digital currencies. Ultimately, it is uncertain if the central bank digital currencies are going to impact cryptocurrency positively or otherwise as only time can unveil what the future holds for cryptocurrencies with the emergency

of the central bank digital currency.

Discussion about this post